Guide to Doing Business in the Netherlands

If you are thinking of doing business in the Netherlands, you will need to familiarize yourself with the country's business culture and legal system. In this blog post, we will provide an overview of the Dutch business landscape, including information on starting a business, tax advantages, Dutch etiquette, and more. We also provide tips on finding office space and setting up a virtual office in the Netherlands.

FAQ on setting up a company in the Netherlands

To set up a company in the Netherlands, you will need to go through the process of company registration. This process can be complex and there are a number of steps that you will need to take in order to complete it. The following steps will give you an overview of the process of company registration in the Netherlands.

FAQ on running a business in the Netherlands

Once the company has been set up, there are several things you should arrange. Below are the most frequently asked questions of foreign business owners after they have set up their business.

Get your business in the Netherlands started?

Get in touch with us to learn more about our company services. Our network of professionals gladly helps you starting up your Dutch business.

Choose a legal entity and structure

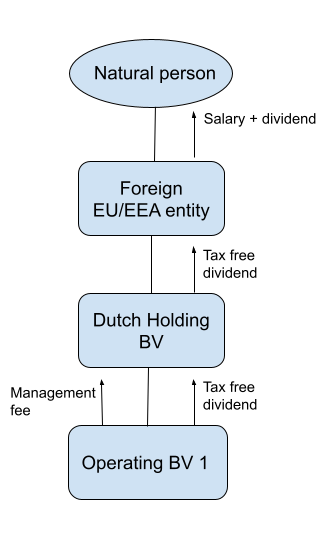

Establishing a business in the Netherlands involves choosing a suitable legal form. Options include sole proprietorship, partnership, and BV limited liability company. However, only the BV can be managed from abroad and offers a low corporate tax rate, making it popular. Foreign entrepreneurs can create a Dutch daughter company, set up a single BV, or form a BV holding structure. The latter, providing tax advantages and bankruptcy protection, is preferable if the Dutch entity isn't a daughter company of a foreign entity.

Dutch holding structure

The Dutch BV holding structure has two main advantages: lower risk-profile and a lower tax burden.

The business activity will take place in the operating BV. The holding BV will deliver 'management services' for the operating bv. Any profits made in the operating bv can be transferred as dividends to the holding BV without having to pay dividend tax. You will also not pay double profit tax over this profit. Plus, there is no inter-company dividend taxed, so this transfer is tax-free. In case of bankruptcy of the operating BV, your assets that you have "moved up" (cash, IP etc.) to the holding will be protected.

Also, if you one day sell the operating company, you will receive the profits from the sale in the holding where you can keep the money without paying additional profit or dividend tax over the sale. You can reinvest this tax-free from the holding into another entity. If you do not have a holding in place, the sales profit will be paid out immediately to yourself and you will pay much higher personal income tax over the sale profit.

Read more about choosing the right legal entity and structure in our guide.

Incorporate and register the BV

Different than in for example the Nordic countries, the Netherlands has a special type of lawyer who has to sign off on the legal paperwork. This person is called a notary (or notary public). Although the process has become more and more digital, a lot of work is still manual. There are very many notaries and some are more modern than others. On top of that, you will have to be on the look-out for professionals who are used to working with international clients.

The notary checks all the required documents. It is possible to sign the documents remotely. If you opt for that, you might need to get some of your documents stamped in your home country. Among other things, the notary will provide you with a so-called power of attorney. The notary will instruct you on what documents you should get stamped (or legalized).

After you have signed everything, the notary will register the BV at the chamber of commerce. Unlike in some other countries, this is a mandatory registration. The costs for the chamber of commerce registration are around 75 euros. It usually takes 24 hours until the registration is finalized after which you will be able to find your company in the register.

Business opportunities in the Netherlands

The Netherlands is a great place to do business, thanks to its strong economy and favorable business climate. There are many opportunities for businesses in the Netherlands, including in the manufacturing, agriculture and services sectors. The Dutch market is also well-connected with other markets in Europe and around the world, making it a good location for export-oriented businesses.

The best industries to start a business in the Netherlands vary depending on the specific sector and region. However, some of the most promising sectors for Dutch businesses include:

- IT products and services: If you are thinking of starting an IT business in the Netherlands, there are many opportunities waiting for you. The Dutch IT sector is thriving, with many companies offering innovative and cutting-edge products and services. In addition, the Dutch market is well-connected with other markets in Europe and around the world, making it a good location for export-oriented businesses.

- E-commerce: the Dutch market is very open to online commerce, with a extraordinarily high rate of internet penetration and a large number of online shoppers. In addition, the Dutch are comfortable making purchases online, and they are used to paying for goods and services with various payment methods.

- Agriculture: The Netherlands is a major producer of agricultural products, including meat, dairy, vegetables, and flowers. There are many opportunities for agri-businesses in the Netherlands.

- Manufacturing: The Netherlands is a leading manufacturer of machinery, chemicals, and other industrial products. If you are looking to start a manufacturing business in the Netherlands, there are many opportunities available.

- Services: The Dutch services sector is thriving, with many opportunities in sectors such as consulting, tourism, healthcare, and financial services. If you are looking to start a service business in the Netherlands, there are many opportunities waiting for you.

Challenges of doing business in the Netherlands

There are a few challenges to doing business in the Netherlands.

Firstly, the Dutch business culture can be different than what you are used to. Dutch people are known for being very direct, which can be challenging for foreign entrepreneurs. It is important to remember that they are (usually) not being rude, it is simply the Dutch way of communicating.

Additionally, the cost of living and doing business in the Netherlands is relatively high when compared to other countries in Europe. However, the cost of living is still lower than the Nordic countries and parts of the UK. Especially in the city of Amsterdam it can be hard to find housing.

Finally, the Dutch labor market can be quite regulated, which can make it difficult to hire and fire employees.

Read our entire article on challenges of doing business in the Netherlands.

Business consultants in the Netherlands

Accounting in the Netherlands

When doing business in the Netherlands, you will need to keep accurate financial records and file regular tax returns. This can be a complex process, so it is important to seek the help of a qualified accountant.

There are a number of accounting services that a company can use in the Netherlands. For example, you can hire an accountant to help you with bookkeeping, preparing your tax returns, and advising on financial and business matters.

We recommend you to consult an accounting professional to find out which accounting services are best suited for your company.

Accountants and bookkeepers in the Netherlands

Tax advantages of doing business in the Netherlands

The Dutch tax system offers a number of advantages for businesses, including a low corporate tax rate for SME's and a wide range of tax incentives. Additionally, the Netherlands has double taxation agreements with many countries, which can help to reduce your tax bill.

Some of the other tax incentives available in the Netherlands include the research and development tax credit, the foreign-trade deduction, and the investment allowance.

Another well-used tax advantage is the "30 percent ruling" which allows foreign employees (including those setting up their own limited company and employing themselves in it) to get a large tax cut on their personal income tax.

Finally, the Dutch holding BV structure offers international businesses certain advantages in optimizing their legal and tax structure.

If you would like to find out how much you will need to pay as a business or person in the Netherlands, check out our tax guide for the Netherlands.

Tax advisors in the Netherlands

Tax, accounting, legal compliance & insurance

Now that you are the proud owner of a BV with a Dutch bank account, you will at least need to keep an orderly administration, file for corporate income tax return, file and deposit annual accounts. This is done by a Dutch accountant.

Second, you should check if you need to have any legal documents in place. And third, check well if you need to take out any insurance.

The administration and tax obligations are relatively simple and usually not too costly. On average you will pay between 1000 and 2000 euros per year for full administration and tax services. This should include:

- Full bookkeeping package

- Quarterly VAT (BTW) return

- Corporate income tax return

- Annual accounts

- Personal income tax for main director/shareholder

Find a full overview in our guide on accounting and tax returns for SME's.

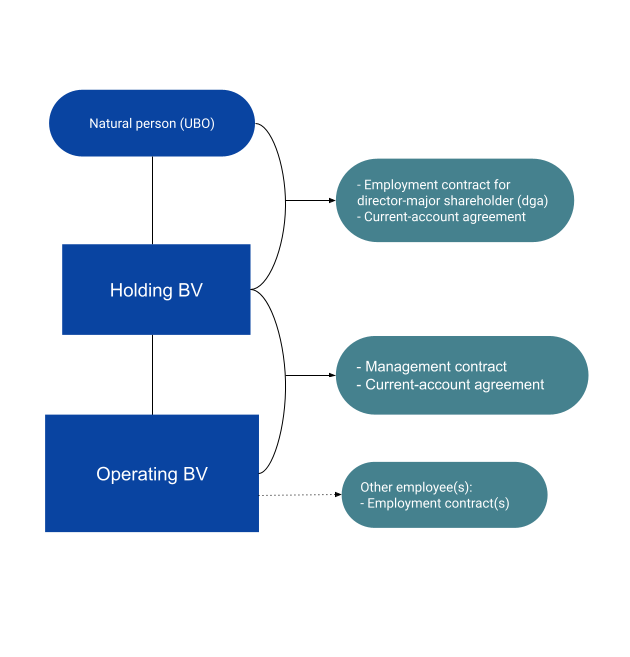

Legal compliance for a BV usually includes:

- Shareholders agreement (if more than 1 shareholder)

- Management agreement (between holding and operating BV)

- Employment contract (if anyone is employed by the company)

- GDPR privacy agreements (if the business deals with personal data)

- Many others!

Insurance

Company insurance is not mandatory in the Netherlands. However, it is usually wise to take out insurance based on your company's activity and risk-profile. For example, you can take out liability insurance if you want to be sure that you are well protected from claims. These days there are even cyber security insurances to compensate damages from hackers or data leaks.

Opening a business bank account in the Netherlands

Opening a bank account in the Netherlands can be a complex process, so it is important to seek the help of a qualified accountant or consultant.

A bank account can be set up after the company has been registered in the chamber of commerce registrar (KvK). This is done within 24 hours post-incorporation. With the chamber of commerce registration number, you can visit any bank and open a bank account.

It is important to keep in mind that banks in the Netherlands often have specific requirements on who is allowed to open a business bank account. Some require a resident director, others even a Dutch national on the company. These requirements are continuously shifting, so make sure to apply at several banks.

There are a number of different banks in the Netherlands, each with their own set of products and services. It is important to research the different options and find a bank that best suits your needs. If you are looking for large business banks where you can get a business loan and other business services, we recommend ING or ABN AMRO. Perhaps you only need a relatively simple business bank account. In that case you are best of with Bunq. This is a fully-licensed bank that is completely mobile. Their customer service is excellent and their products well thought through.

Read our full guide on opening a business bank account

After you open the business bank account

First of all, do not forget to deposit the share capital in the business bank account. If you fail to do that, you will still be personally liable instead of the company itself.

Furthermore, a VAT number follows on average 7 working days after registration at the chamber of commerce. Obtaining a VAT number has not proven to be a problem for most of our clients. However, you should be aware that opening a bank account is much easier if the company has a resident director on the board.

Finally, it is important to have a well-established address, not just any address.The office address is one of the factors looked at by the tax authorities when they review your application.

Business banks in the Netherlands

Visa and relocation to the Netherlands

EU nationals can freely work, do business and live in the Netherlands. There are no restrictions on where they can work or live. Additionally, there is no need to apply for a visa or residency permit to live in the Netherlands.

If you are not an EU national, you will need to obtain a visa and residency permit in order to work or do business in the Netherlands. The process for obtaining a visa and residency permit can be complex, so we recommend you to consult a legal professional. You can also read more which rules, visas and advantages apply in your situation on the Dutch Immigration website.

Relocation and Visa Experts

Business licenses in the Netherlands

There are no business licences need to start up a business in the Netherlands. However, certain industries require businesses to have additional licences, certificates or other paperwork in order. Examples are parts of the logistics industry, the pharma and biosciences industry and selling financial or insurance products. We recommend you to consult a legal professional if you are active in a regulated industry.

Business contracts and legal compliance in the Netherlands

When doing business in the Netherlands, it is important to have a number of legal contracts in place. These contracts will help to protect your interests and ensure that your business is operating in accordance with Dutch law.

Some of the most important legal contracts for businesses in the Netherlands include:

Employment contracts: All employees in the Netherlands must have an employment contract. The contract should specify the terms and conditions of the employee's employment, including pay, hours, vacation, and benefits.

Contractor agreement: A service contract is a contract between a service provider and their client. The contract should specify the services that will be provided, as well as the price and payment terms.

Terms and conditions / terms of service: General terms and conditions are conditions that are intended to be part of multiple agreements. These terms and conditions are often referred to as the ‘small letters’. They describe conditions, such as delivery conditions and payment conditions but explicitly do not indicate the core of the agreement.

GDPR documents: for example a privacy policy, cookie statement and data processing agreement. Companies that process the personal data of EU citizens must comply with the GDPR unless they can demonstrate that they meet certain conditions specified in the GDPR. Failing to comply with the GDPR can result in significant fines.

Browse all relevant business contracts in the Netherlands in our legal catalogue.

Legal advisors and lawyers in the Netherlands

Office, virtual office and real estate in the Netherlands

The Netherlands is a country in northwestern Europe with a population of more than 17 million people. The Dutch economy is the sixth largest in the world and is dominated by services, which account for more than three-quarters of GDP. The Dutch office market is one of the most expensive in Europe. Amsterdam is the most expensive city to rent office space in the Netherlands, followed by Rotterdam and Utrecht. Despite this high cost, the Dutch office market remains very competitive.

When looking for a virtual office in the Netherlands, it is important to choose a provider that is reliable and offers a range of services that meet your needs. Some of the most important services to look for include:

- A professional and business-like mailing address

- A local Dutch telephone number

- A range of office services, such as meeting rooms, secretarial services, and call forwarding

- The ability to work from anywhere in the world

Read more about offices and registered addresses in our guide

(Virtual) office providers in the Netherlands

Get funding for your Dutch company

There are a number of ways to get funding for your Dutch company. One of the most popular methods is to raise money from private investors. Private investors can be individuals or companies that are interested in investing in your business. The Netherlands has a wide network of so-called Business Angels.

Another option is to seek funding from venture capitalists. Venture capitalists are investors who are willing to risk their money in order to help young or high-growth businesses grow. They typically invest in businesses that have the potential to generate a high return on investment.

You can also look for funding from government organizations or banks. Government organizations often provide funding to small businesses that have a strong track record and are considered to be high-growth businesses. Banks typically provide loans or lines of credit to businesses that can demonstrate that they have a sound business plan and are likely to repay the loan.

Read more in our guide on financing your business in the Netherlands

Investors and lenders in the Netherlands

Dutch business etiquette

It is important to be aware of the Dutch business culture and etiquette when doing business in the Netherlands. For instance, appointments are generally required for meetings, and punctuality is highly valued. Business dress is usually casual, but in some cases more formal wear is appreciated. Gifts are not typically given during business meetings.

When shaking hands, it is customary to shake hands with everyone in the room. It is also important to maintain eye contact when shaking hands and during conversations. Business cards are typically exchanged after the initial introductions. Post-covid it is accepted not to shake hands. However, in practice it is still the norm.

The business culture varies per industry. You should be aware of the business culture in your particular sector, especially your customers' behaviour. For example, if you selling products or services online in the Netherlands, it is important to understand the Dutch consumer mindset when it comes to online shopping. The Dutch are very price-conscious and they often do research before making a purchase. They also expect very good customer service, so make sure you have a strong customer service strategy in place.

Interested in exploring Dutch business opportunities?

Starting a business in another country is always tricky. However, there are a few countries in Europe where they are so used to setting up new companies that the process is almost effortless. One of those countries is the Netherlands. Compared to its neighbours, the Netherlands has very little bureaucracy and has a very friendly attitude towards international entrepreneurs. That friendliness becomes clear when looking at all the tax incentives and the low corporate taxes in general. This has made the Netherlands the largest recipient of foreign direct investment (FDI) in entire Europe.

NordicHQ has an office in Amsterdam, specialized in guiding foreign entrepreneurs on their business journey to the Netherlands and the rest of the European mainland. Feel free to contact us by email or contact us directly via our contact form.

Guide

REQUIREMENTS

REGISTRATION

Registration at the Chamber of Commerce

AFTER REGISTRATION

After the company incorporation

Company formation consultants in the Netherlands

Further reading

Factoring for Businesses in the Netherlands

Expanding your business into the Netherlands and the wider EU presents exciting growth potential. However, navigating the financial landscape and managing working capital can introduce new challenges. Factoring is a valuable solution for many businesses, especially those originating from outside the Netherlands. What is Factoring? Factoring is a financial service where you sell your outstanding…

Types of Funding for your European Venture in 2024

There comes a moment in many European businesses’ lives when internal resources just aren’t enough. Fueling expansion, solidifying growth, or transforming that brilliant idea into reality needs external support. Selling equity for an investment can make sense, but there are several other ways of structuring it. Let’s quickly go through the different options. If you…

The SAFE: A Simpler Way to Invest in Startups

The journey of a startup is fueled by innovation, but also by access to capital. In this fast-paced landscape, a financing mechanism gaining popularity is the SAFE. Here’s a breakdown of SAFEs, why they’re appealing, and the nuances to be aware of. What is a SAFE? A SAFE stands for Simple Agreement for Future Equity….

How to recruit talent in the Netherlands

The Netherlands boasts a flourishing job market filled with highly skilled and diverse professionals. To successfully attract the best talent, you’ll need a nuanced strategy across the most effective recruitment channels. This guide offers a comprehensive breakdown to help you fill roles within your Netherlands-based company, from entry-level to executive hires. LinkedIn: The Recruitment Powerhouse…

Dutch Startup Visa – Requirements and Prices in 2024

Here’s an extensive article on the Dutch Startup Visa program, including requirements and application details: The Netherlands is rapidly becoming a leading European hub for startups and innovation. The Dutch government actively seeks to attract ambitious international entrepreneurs. To foster this ambition, the Dutch Startup Visa allows those from countries outside the European Union (EU),…

Netherlands’ 2024 Tax Changes – Key Takeaways for SMEs

As 2024 unfolds, SMEs in the Netherlands face a new tax landscape, shaped by the ambitions of Rutte IV and a proactive parliament. This article summarises the crucial tax changes impacting SMEs, ensuring businesses are well-informed and prepared. Key Tax Changes in 2024 Income Tax Adjustments: Box 3 Wealth Tax Revisions: Tax Benefits and Deductions…

US company looking for NL BV setup for EU Expansion

Question: We are a company based in the United States and we are in the process of expanding to the EU. Our goal is to create a BV in the Netherlands for our European operations. We have looked into this and are ready to proceed but we need a little more information before we make…

Seeking Advice on Donations and Tax for Dutch BV

Question: Our start-up, which focuses on developing innovative solutions for early Alzheimer’s detection, is considering adding a donation feature to our website to support our initiatives. I have a few important questions and would be grateful for your insights on these matters: Answer: The company (BV) can receive donations, but they will most likely be…

Entrepreneur’s Dilemma in the Netherlands: Business or Personal Tax Payment for 2023?

Explore a Dutch entrepreneur’s decision-making process for tax efficiency in 2023, weighing between business and personal tax options under the Dutch tax system, including the 30% ruling impact. Question: I’m seeking guidance on how to most effectively manage my tax payments for the year 2023. Here are some key aspects of my current situation: I…

Work Permit Options in the Netherlands for Non-EU Workers

Question: I represent a business group that has recently established a company in the Netherlands, with a significant portion of Dutch ownership. This new Dutch entity shares the same ownership structure as our existing company in another European country. Our inquiry is about the possibility of employing individuals from non-EU countries directly through our Dutch…

US Resident – Dutch BV salary and taxes?

Question: I’m looking for guidance on a business structure I’ve recently established. My business partner and I have formed a BV and Holding company. My partner, who lives in the U.S. and is a U.S. resident, shares equal ownership (50-50) with me in this company, and we both serve as directors. I’m curious about the…

Netherlands Euro Haulage License

Navigating the process of obtaining a Euro haulage license in the Netherlands can be a crucial step for businesses engaged in the commercial transport of goods. This article provides a comprehensive guide on the requirements, regulations, and application procedures to help you secure a license and stay compliant with the European Union’s transportation laws. Join…

Work permit for UK director’s business visits from UK to EU country?

Question: I am wondering whether I, as a UK citizen and resident, can set up a BV and then visit the Netherlands and work at our Amsterdam office (here we will have several of Dutch employees). The visits will be from a few days to a week or so after which one of the other…

Establishing a European NGO as a US Nonprofit

Question: Being a US-based nonprofit, we’re looking to expand our presence into Europe. Which European countries would you recommend considering the following criteria: 1) Incorporation costs; 2) Simplicity and speed of the registration process; 3) Ongoing maintenance costs; 4) Necessity of a physical office, given our remote work model; and 5) Other notable advantages or…

Q&A: VAT in Dutch EU Operations (UK Ltd. main office)

Question: As the CEO of a UK-based enterprise that specializes in distributing consumer electronics to various regions in the UK and Europe, we’re contemplating expanding our operations next year by establishing a subsidiary in the Netherlands, with our main UK entity as the shareholder. We’re considering partnering with a third-party logistics center in a central…

KVK and VAT for Scaffolding in the Netherlands

Question: I operate a scaffolding business that is tax-resident in Slovakia with primary operations in Sweden and Slovakia. My team and I focus solely on the construction and demolition of scaffolding. We’re looking to expand as subcontractors to the Netherlands for a limited period, not exceeding 12 months. Our posted workers will be in the…

I want to set up a food truck business in the Netherlands

Question: What are the key steps for setting up a sole proprietorship food truck business in the Netherlands, starting with just one truck and no employees? Answer: It can make sense to set up a sole proprietorship (often called ZZP or eenmanszaak). Once your business grows you can simply transfer the eenmanszaak/ZZP into a new…

The European Dream: A Guide for American Entrepreneurs Moving to Europe

The statistics are telling: From 2013 to 2022, the number of Americans in the Netherlands grew from about 15,500 to 24,000; in Portugal, it tripled to nearly 10,000; and in Spain, it increased from around 20,000 to 34,000. Moderate to steady growth was observed in countries like France, Germany, and the Nordics. Britain alone saw…

Can My Own BV Sponsor Me in the Netherlands and Can I Keep the 30% Ruling?

Question:I’m a Brazilian citizen working full-time in the Netherlands with a recognized sponsor under an HSM visa. My wife is also here on the same visa. I benefit from the 30% ruling. I plan to leave my current job to start a consulting agency under a BV structure. Can my own BV sponsor me and…

Key Proposals from Prinsjesdag 2023

Prinsjesdag is an annual event in the Netherlands where the government presents its plans for the coming year, including budget proposals and policy measures. Note that these are proposals and have yet to be approved by the Parliament. Here’s a summary of key proposals from Prinsjesdag 2023 aimed at understanding the complex Dutch system. Supporting…

Challenges of doing business in the Netherlands

The Netherlands is a great place to do business, but there are some challenges that you need to be aware of In Europe, the Netherlands has some distinct advantages that make it an especially attractive destination. First of all, the Dutch have a long history of trade and commerce, and they are very open to…

Start a transport company in the Netherlands

Of all European countries, the Netherlands is probably the most suitable to start your transport company. There are many reasons why the Netherlands is such a huge player in the logistical industry. For example, because of its geographical location the Netherlands is a major gateway into the European market. Because of this the country has…

A Guide to Cyber Security for SMEs in Europe

Every day, businesses fall victim to cyber crime. Whether it’s a ransomware attack that locks down your computer systems until you pay up, or sensitive customer data being stolen and sold on the dark web, the risks are real and growing. If you’re an SME, it’s crucial that you take steps to protect your business…

The Netherlands compared to the rest of Europe

The Netherlands compared to other European countries This article will delve into a comprehensive ranking and comparison of the Netherlands with its fellow European nations, focusing on key business indicators, such as ease of doing business, innovation indices, economic stability, digital infrastructure, and tax regimes. By juxtaposing these factors, we aim to provide a nuanced…

Why the Netherlands is a Leader in Sustainable Business and Renewables

Businesses worldwide have to change the way they operate as we learn about how urgent it is to protect our environment. While this transition may be difficult, it’s crucial not only for the planet but also for businesses’ bottom lines—in fact, making eco-friendly choices actually helps businesses succeed. Reducing waste, energy consumption and raw materials…